top of page

The Ledger

Thought Leadership in Investment Strategy & Capital Markets

Summer Series Part III: Transmission Lines — Private Credit and Insurance Balance Sheets

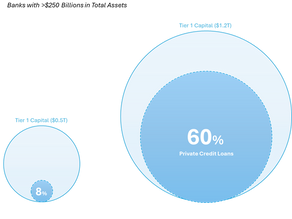

Private credit is recasting the circuitry of the financial system. In the final part of our Summer Series, we examine how insurance affiliates, NAV lines, and offshore reinsurance transmit stress. The system does not need to break to fail. Sometimes pressure just moves faster than recognition.

Sep 2, 20259 min read

Summer Series Part II: Extend and Pretend, Again — A Behavioral History of Debt Deferral

"Extend and pretend" is not a post-GFC invention. It is a century-old instinct. In Part II of our Summer Series, we explore how debt deferral, maturity wall fears, and strategic inaction have repeated across cycles, from 1930s bank policy to 1990s Japan to today's CRE market. With historical quotes, visuals, and behavioral insight, we examine why delay often becomes the most rational path, until it no longer is.

Aug 5, 20258 min read

Summer Series Part I: Lending Signals and the Repricing of Office Values

As capital markets recalibrate around sustainability and obsolescence risk, the office sector faces a stark financing divide. Modern, green assets are commanding tighter spreads and higher leverage, while legacy buildings are being priced out of the debt market entirely. In this analysis, we explore how lenders are redrawing the underwriting rulebook and what it means for the future of office real estate.

Jul 8, 20255 min read

Get the Signal

Before the Shift

Actionable research on trends, value, and risk in your inbox monthly.

bottom of page